Chase Bank Mortgages Consumer Reviews

TEXAS -- When I think I can't possibly LOATHE JP Morgan CHASE Bank any more... A deeper pit of disgust is uncovered.

It's like thinking you stepped on a banana peel & later discovering it was dog shit that you have tracked everywhere instead of banana slime. They incessantly raise the bar as a bastion of excretions!

Chase Bank Mortgage representative on a recorded call to Chase Bank The Heights Branch Employee Griselda stated ‘there was a process in place by which an heir simply completed paperwork to assume complete and full responsibility for a mortgage with no need to qualify or pay fees'. Chase bank has admitted to finding these recordings and that there is ‘at least partial error' on their part' and now they want me to attempt to qualify for this loan while they ‘see what they can do'.

Based on this information from bank employees from the bank holding my mother's hoarded, underwater loan, I proceeded to do much work to bring the property back up to value. Work and funds expended included 10 days of assistance by many of my mother's friends removing items to good will/ other nonprofits, renting large dumpsters and exposing these friends to an environment that the homeowner's insurance policy claim team deemed Hazmat contaminated. Moving forward to process the homeowner's policy insurance claim, which included subcontracting o a Hazmat trained cleanup crew and special waste truck for some of the debris. Then moving forward from a gutted property to beginning to restore the property (all while Chase STILL managed to find reasons to withhold the insurance check in an escrow account!) This meant withdrawing funds for my mother's (now beneficiary) IRA and accruing taxes and penalties and fees to have the funds to pay the contractor. Now that the property is improved beyond original, Chase comes forward to say there was a mistake & they are sorry… Sorry doesn't fix a broken plate once it hits the floor. You are either pregnant or you are not so there is either a CHASE error or there is not! I would not have endured all the stress, subjected my mother's friends to the environment, been hospitalized with takutsubo cardiomyopathy, much less spent this huge amount of funds for a ‘long term retirement investment' had Chase simply told me the truth! I would have walked away & allowed them to foreclose on a property that was worth less than half the loan!!

I have additional questions regarding [predatory lending as I am curious how my mother, an active duty deceased military widow whom was retired and unemployed could qualify for this loan with a 100+K balloon payment to occur 40 years later - when she would be over 100 years old!

There is lots more errors & bank visits and being on hold & numerous call but they don't have results directly to this except to add to the overall miserable experience of wasting time – it becomes too much to keep track of. I have used comp and vacation time to handle these calls during my work hours. The stress has been unimaginable. I would have walked away from this hoarded property that the home wonders insurance claim used a hazmat cleaning team and special hazmat waste truck to remove times from the back areas After I had already paid for severely dumpsters and exposed my mother's friends to 10 days' worth of exposure to the environment, plus all the emotional s tress and work of removing things to the trash or Good will. I would have walked & let Chase foreclose on a property that was worth less than half the mortgage! Had they given me the truth! Initially or at any point during any of my numerous communication, in a branch, on the phone with numerous Chase representatives!

I just want to state clearly how MUCH I RESENT CHASE BANK. Their uncaring error of telling me they were sending a check to be delivered to my contractor 10/26(and to date STILL NO APOLOGY OR DELIVERY!!) as created tension, mistrust and concern between my general home contractor and myself.

- Clint Cable Stated this morning, “He could not Trust My Word Because I had told him a check would be coming 3 times and even when I had a confirmed by CHASE RECORDED PHONE CALL from a Chase Insurance representative to A Chase The parks Branch Manager Bell statement from Chase that I check would be coming and it STILL HAS NOT ARRIVED – Because I trusted Chase AGAIN in the issue of mailing 20K from the insurance escrow account where CHASE is withholding additional funds- I now have a poor relationship/ lack of trust and loss of credibility with my contractor!! It is a HUGE shame to have my working and personal relationship with this individual tarnished because of Chase Bank representatives uncaring /unprofessionalism and inability o be capable of following thru on even simple things.

CHASE LIED AGAIN on their own recorded call between The Parks Branch Manager Bell and the Insurance representative. No 20K Check has yet to be delivered to my contractor!!

Replies

Replies

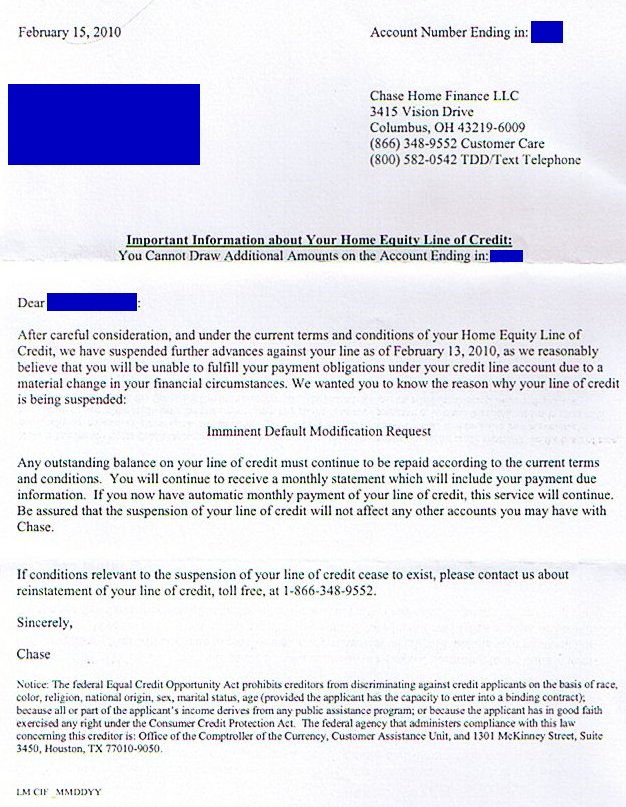

COLUMBUS, OHIO -- By applying for a Chase home loan modification or forbearance, they have turned around and hurt me financially even more! I have been trying to get a mortgage modification through Lake County, Ohio Fair Housing for nine months. What a vicious joke Chase played. The latest hit was a letter I just received from Chase that they are freezing my line of credit on my house (I didn't know I had one) because they learned that I was in financial difficulty!

I am just trying to finish school so I qualify for a job! WARNING: by applying for a modification or forbearance, Chase has turned around and hurt LOTS of people financially even more!!! They froze this line of credit weeks before they mailed this letter informing me!!!

My house is not worth less than when they financed it. They even re-appraised it during my attempted modification. So, how can they justify cutting off a credit line when the loan is secured - when I have never missed a payment! Could an even bigger profit motive be involved?

As an over fifty-seven year old displaced (unexpectedly divorced) homemaker, I was getting a grant from Ohio. That got canceled during the financial meltdown. Because I knew I would be facing economic hardship before my degree completion, I sought help for which I was qualified.

When I first got my Chase mortgage, I was assured it was a standard 30-year mortgage, but a "hybrid." Then, I learned from Fair Housing that Chase says it is an equity line of credit. That, according to what Chase told Fair Housing, disqualified me from a "forbearance" while I try to finish my degree. A couple weeks ago, they informed Fair Housing that they are not looking at "first mortgages" until late April. Why didn't they say that nine months ago?

When I applied, I was working many more hours. When they forced me to resubmit all financial data for different three month periods, I was working less and was denied modification on the grounds that I could not afford my mortgage! (This is a repeating cycle with them - all the while, my financial status deteriorates.) I have an on-campus student worker job - and campuses have numerous non-paid closed days! I am restricted by law to working a maximum of 25 hours a week during the spring and fall semesters! And, without an Associate's Degree, I cannot become a preschool teacher in Ohio!

I have been doubly screwed by Chase! I quit jumping through hoops to submit more documents, since I had figured out that they would never be satisfied - so they slapped this credit freeze on. Now, my credit is damaged! Thanks for nothing but stress and financial distress, Chase mortgage folks.

By the way, I am not the only one angry with you. Have you googled yourselves lately? It appears that your generous offer to modify loans may have been nothing more than a ploy to bleed your customers bone-dry before you foreclose.

I have written President Obama and all my state politicians. I am hoping to attach my name to a class-action suit. And, thanks for the toll-free number I can used to request a reconsideration if my financial status changes. The thought of dealing with you just warms my heart - NOT!

Thanks (truly) to a supportive family and supplemental work - I will not fail to make my monthly mortgage payments, even at the current interest rate. Unless, of course, you find other ways to harm me as others have reported - not crediting payments, throwing whole payments into escrow and filing foreclosure for non-payment on loan, setting up three months of trial payments, not applying them to the mortgages, demanding lump sums, then not approving the modified loan agreements, etc. Really. This is some bad business.

Replies

Replies

OHIO -- As the Seller I have been treated horrible, and after 67 days our home still has not closed and we still have no closing date. Working with Chase Mortgage has been a nightmare. Our pre-qualified buyer and I decided to use Chase Mortgage Banking since we're both Chase customers. However, if we had known in advance of the incompetence, inexperience, lack of professionalism and continuous resubmission of documents, we would not have used Chase to close my home.

Every time I tried to personally get information from the lender he said I had to ask the buyer, because he couldn't give me information for privacy reasons. Since when can't a lender give the Seller information regarding the buyer's documents status and the closing updates on Seller's home?

History: I put my home on the market December 8, 2017. The buyer and I signed the contract December 30, 2017. January 2, 2018 Rex ** of Chase Mortgage received our contract and said everything looked great and we should be able to close in 35 days or by February 9, 2018. The appraiser came on January 12, 2018 and we renegotiated the price based on the appraiser's low estimate (that is another complaint), with an addendum to our contract.

The new addendum was signed and submitted to Chase on January 21, 2018. By the way, per the original contract the approval letter should have been submitted within 5 business days. That didn't happen. Our buyer received her approval letter via mail on February 23, 2018.

Complaint: On February 6, 2018 when I complained to Rex **, Home Lending Advisor about the lack of communication on updates, changes, documents, closing and response to questions asked, he said not to speak with him and to solely communicate with our “first time” home buyer for information and feedback in the future. Chase lending has not been responsive to me, the buyer or the Attorney's office with updates or the closing status. After 67 days, no one knows what is going on. Is this how Chase Mortgage trains their lending staff to treat “valued” mortgage customers, or is this treatment reserved for Blacks and Hispanics?

After selling three homes, Chase lending has been the absolute worst experience. The treatment throughout this process is unacceptable. Every promise Chase Mortgage has made has been broken, without apology. HORRIBLE Mortgage to use. DO NOT torture yourself through the living hell of using Chase Mortgage Lending.

Replies

Replies

TEXAS -- In 2015 I did a home loan modification and received paperwork regarding it. In March 2017, I decided to look at selling my home. I called Chase and asked them for my payoff amount including the modification amount because I knew it existed. They mailed me the payoff. I meet with my realtor who asked me to confirm my payoff to ensure that I would not have any legal issues. I again call to ask Chase about my payoff. They again tell me it is "x" amount. I insist that they look again because I know there was an additional amount after the first amount was paid off that had to be paid. I'm told "NO", that amount doesn't exist, it was interest and no longer has to be paid.

I asked to confirm and they told me there was no other amount. I explained again that I needed a correct payoff because I didn't want legal issues later. I was told not to worry about it. I asked for a copy of the recorded conversation and was told I couldn't get one but they would have it on file. My home is still pending and everything is going good until the Title Company starts working on the documents for closing and a second mortgage shows up. I call Chase 2 additional times regarding this and am told there is only 1 mortgage loan.

The title company calls and is told the same thing, only 1 mortgage loan. They ask for it in writing and she faxes Chase the paperwork. Chase sends back the paperwork including a second mortgage that they said didn't exist.

I call them regarding it and am told that they are sorry they overlooked it. Four different times I called and they overlooked $31k. Even when I insisted I knew that amount existed I was told it was wiped clean because of the type of modification I did.

Chase Mortgage sucks and they don't want to do anything about their mistake because I signed a paper. Yes I signed a paper to modify my loan but I called 4 times regarding my payoff and advised them of that amount and still it's my fault. I DON'T THINK SO!!!

Replies

Replies

BOSTON, MASSACHUSETTS -- Chase Mortgage is a criminal Enterprise!!! In 2008 they were bailed out by the AMERICAN PEOPLE. Then they bought their stock back and padded their wallets. In December 2019, I applied for a refinance. I was completely upfront with them. I asked the representative, William Endres that if he didn't think it would work, not to waste his time or mine. He said "NO PROBLEM", I just need a $500 retainer on your credit card to proceed. Don't worry James, its fully refundable if you don't qualify!!! 60 days later, after making me jump through hoops....they tell me they can't do my loan because my house was in a trust. How about telling me day #1, that you couldn't do it you MORON. LIE, CHEAT and STEAL. And they won't give me my money back. If anybody know how I can SUE them, please let me know. BTW, I then called a local mortgage company and was approved in 24 hours and closed in two weeks!!! They need to pay for treating people like this. They are horrible monsters and deserve to PAY!!

Replies

Replies

Chase sold my mortgage to a company that most people have never heard of and Chase did it after my home was flooded by Harvey. I went to Chase right after my home was flooded. Chase assured me they would work with me. Chase knew that I was going to try again to get home refinanced through them. I had tried earlier but the transaction was canceled because Chase did not get paperwork through in time so my money was refunded. I was going to try again once my home was back the way it was before flood.

Chase decided to sell my mortgage and the only way I found out was when I went back to Chase to ask them about my mortgage and if they could extend it further out like most mortgages were doing as I still have ongoing repairs. That's when I found out my mortgage had been sold and that Chase wanted the past months of mortgage paid now in two payments. If you currently have Chase as your mortgage lender be aware that if your home is ever severely damaged, they will more than likely sell your mortgage. If you are looking for a mortgage lender, I would advise someone other than Chase.

Replies

Replies

PASADENA, CALIFORNIA -- I paid my mortgage off early almost three months ago and am due a check for the refund of interest I paid. Before I finished paying the mortgage off, my partner, who is also on the mortgage, died. Chase told me I needed a death certificate for him so they could send me the check in my name only. A representative in the personal savings department, where he had a checking account, said they had one on file.

I can't count the number of times I went from the mortgage department to the personal savings department with promises that it would be sent and then finding out that it hadn't been. It's hard enough repeating that I need a death certificate for a loved one to a new person week after week, but they finally told me they didn't have one at all. I sent the mortgage dept an original more than two weeks ago and since then three people have told me they will open a job order.

Yesterday I was told I have to send them a marriage certificate. Today I received a letter from them asking for proof that I have home insurance. Why would they need to see that when I don't have a mortgage through them? Awful, awful, awful.

Replies

Replies

This is a copy of a letter I mailed to Chase Bank CEO. I am sure he will place it in the round file by his desk and I will never hear back but I want all to know of the bad treatment and shady practices that Chase does.

I do hope that you or the person that you pass this letter off to actually cares about your customers. From the treatment and experiences I have had with representatives of your company I don't believe that anyone there does care about the customer only how much money you can make off that person.

We purchased our home in 2008 as a new build from a builder. In January of that year we had a very good interest rate “locked in”. About three months later we were told that the interest rates had changed and so we no longer had that “locked in” rate. We did not like this but already had too much invested in the home to back out.

We have tried several times in the last 2 years to refinance our home with outside companies as well as with Chase. We have checked many times and we do qualify for every government program that the banks are supposed to have accepted to work for customers in return for the T. A.R. P. funds that they received. We have been rejected on every avenue we have taken with your bank. One representative even had the nerve to tell us to “not make your payments for 6 months then we will refinance your loan”. What the hell kind of advice and treatment is that coming from your representatives?

In July of this year we sent in all the documentation necessary to have our loan modified through the modification program. It seemed that every week we were told that we were missing documents that were sent in or that a certain page wasn't signed (all pages were signed that needed to be). Your company kept losing documents and finding very ridiculous reasons that kept delaying the process.

Now in September we received a letter notifying us that our loan has been sold to another lender. How convenient for Chase. This is too much of a coincidence that our loan is sold during our attempts to have our loan modified so that we can afford to pay our mortgage. Our mortgage went up, by the way, due to Chase grossly mismanaging the escrow account and got us behind on our property taxes and now we have to pay extra to catch those up. I wish that banks were held legally and financially responsible for mismanaging accounts. Your company should pay the bill for your screw up not the customer.

When we first received the letter of our loan being sold, I called and received the worst treatment I have ever received from any company. The representative would not give me her name, kept interrupting me and talking over me while I was speaking, and even had the nerve to place me on hold because she did not want to hear what I had to say.

I asked for a manager and she refused to connect me to one. She said that she would email her manager and he would call me back (which he has never done and it has been over a week now). She told me that my call was not a “manager” call. I told her she does not have the right to make that decision. I let her know that if I, the customer, state it needs to be handled by a manager then it has become a manager call.

I now called back and after several days of no one returning my calls finally got a hold of ** in the modification department. He told me that our modification has been denied and tried to give me some bogus reasons that have to do with I or my wife losing our income for one reason or another such as death, being laid off, having to leave work to tend to a family members bad health etc..

I do not believe it when he or any other representative states that our modification was not approved because of the loan being sold. I don't believe it at all. The facts are we requested modification, Chase kept delaying the process by repeatedly ‘losing' documents, we receive notification of loan being sold dated September 13th; ** told me that the modification was denied on September 17th.

I have been told by ** and the very rude person that has no name, that Chase doesn't make the decision on the modification. I have been told that is done by Fannie Mae, the investor. I know this is a bold faced lie. Fannie Mae is not a loan investor they are merely a guarantor of the loan. They do not care if the loan is modified or not because it does not affect their bottom line. Chase is (was) the owner of the loan and has (had) all say in the decisions of that loan.

The facts speak loud and clear for themselves. Chase sold our mortgage to another lender to avoid having to modify our loan.

As of October 1st, our loan will be handled by another lender. I know that we will have to go through refinance and modification requests all over again. I hope that they care more about their customers than you do. When customers are treated the way that we have been in our situation or similar ones, it is no wonder that many people just give the home back to the bank. They are treated rudely and are not given any assistance when it is desperately needed because of the greed of the bank. But I guess you need to get your money to pay your rent on Park Avenue somehow.

P.S. I signed it from the mortgage number because that is all your customers are to you, a number.

Replies

Replies

I have been a Chase Home Finance mortgagee since September, 2003 a period of almost 10 years. In that time each and every payment was made on time.. In 2005, due to medical expenses that were not covered by insurance, I was forced to declare bankruptcy. During the bankruptcy period all mortgage payments were still made on time. I am 73 and unable to work. My wife is 67 and still employed because we cannot survive without her income.

The crux of the problem with Chase is that I made a mistake in a payment in January, 2007. I paid the amount of $611.96 rather than the amount of $877.96 that was actually due. This problem is that Chase did not notify me for 31 consecutive months that they were charging me a late fee of $23.51 for each and every month since 1/12/07 and that a total of $728.81 in late fees was due at that point. The amount has since grown to over $1,000.00.

Chase claims that, because of my earlier bankruptcy, they would only send Monthly Statements if I submitted a written request. However, the fact is that I did continue to receive Monthly Statements for each and every month, even without making a written request. These Statements, of course, led me to believe that I was current with all monies due Chase.

If Chase had held true to their policy of not sending Monthly Statements without a written request, I would have been forced to contact them, at which point the fees that they were charging me would likely have come to light. It should not fall on me to pay for Chase's failure to follow their own policies.

I believe Chase had an ethical and legal obligation to include any and all fees and balances on the statements that they were sending. Please note that bankruptcy laws did not prevent Chase from continuing to send Monthly

Statements and to accept mortgage payments for 31 consecutive months before notifying me that they were accruing fees against my account. It is especially notable that Chase did not ask for the loan to be reaffirmed at

any time during or after the bankruptcy process. Lastly, it is unconscionable for a business the size of Chase to ambush its small customers in this manner.

I have taken the matter to the Office Of Financial Regulation. As it turns out, they have no authority and can do nothing to correct an abuse by any bank. They appear to be there simply to listen.

Between the bank bailouts and shenanigans such as this, it is little wonder that people hold bankers in such low esteem. I intend to ask my representatives to introduce a bill in both the Senate and the House to prohibit practices such as these. It is patently unfair to attack a customer in a manner such as this. It is also very insulting to be repeatedly hung up on by Chase employees who are obviously unqualified or untrained in customer service.

It has been a lengthy and frustrating battle to attempt to right a wrong, but it appears that the battle is lost. Thank you for reading my complaint.

Replies

Replies

COLUMBUS, CALIFORNIA -- I've been trying to refinance a mortgage, a no-doc, 7/1 interest-only ARM at 5.375 percent, from Chase, which readjusts in August 2012. I'm trying lock in a 30-year fixed-rate conforming loan that ensures I'm able to keep the property until it's paid. I'd rather do this now instead of wait until 2012 when rates may be higher. Current monthly payments are at $2,248.

Due to falling home values, however, a large part of the 20-percent equity I initially put down has been erased. Whereas the home was originally appraised at $580,000 in 2005, the Chase blanket-appraised value is now $495,000. In 2005, I put down $116,000, financed the remaining $464,000 and that balance now stands at $461,789, leaving just $35,211 in equity remaining. However, I believe that a full appraisal will determine that my Redondo Beach, Calif., property in fact is worth substantially more. But a Chase mortgage counselor informed me on 22 January 2010 that I'm not 'streamline eligible.'

Though I'm experiencing no crisis, I consulted with an independent mortgage-crisis counselor to explore what I might do to improve my ability to qualify. They informed me that my chances are nil - unless I want an FHA loan with PMI, which I don't, or unless I experience a crisis (missed payments, default, possible foreclosure, etc.), which compels the bank to take some action. I don't care for that option either. I'm not looking for a rescue.

Why is a responsible and sophisticated financial consumer, such as me, forced to choose between those two equally undesirable options? Unlike many these days, my finances are in decent shape. I asked Chase to consider my: Good credit: my FICO score is in the 790-800 range; Timely repayment history: I haven't missed or been late on a payment to any creditor in many years. Property improvements: we made substantial upgrades to the residence. Additionally, our HOA invested nearly half a million dollars in improvements to the complex; Equity: we're not underwater. In fact, property values in my neighborhood are stabilizing;

Higher income: my income today is roughly $20,000 more than it was in 2005; Greater personal savings: despite the financial crisis of 2007 - 2009, my retirement accounts all have higher balances than in 2005; Lower credit balances; again, despite the crisis, I've paid down my balances. All my credit balances trend downward historically;

Financial savvy: as a successful, independent, institutional asset-management marketing consultant, I treat my assets and liabilities as an institution might. I've been a long-term consultant with a leading financial firm since 2001 and this gives me access to large amounts of sophisticated and forward-looking financial insight, which I put to use in my personal life; Income property: I also have a tenant who covers the mortgage on a second property in Hermosa Beach, Calif., which is due to be paid off in nine years. This provides tax benefits, but unfortunately impacts me negatively on my mortgage application.

I'm certain I represent extremely favorable credit risk to any bank that works with me to refinance this loan. Further, it would enable Chase to remove a risky, 7/1 interest-only ARM from its books and replace the loan with a safer 30-year fixed-rate loan to an AAA-type borrower with the capacity and intention of repaying the obligation - which might look good to regulators. If Chase offered me a rate at or near 5 percent, without PMI, it would increase my current monthly payment amount by only a few hundred dollars, which is very manageable.

Chase Home Finance has denied my refinance application and basically is penalizing me for being a proactive borrower who's working to prevent a potential future problem with my home. They're forcing me to roll the dice in 2012 and hope that I can refinance or sell by then. Apparently, no one at the bank has the foresight or the authority to look more closely at my unique circumstances, do some community banking, make a sensible move, and offer me a refinance. As a result, I have to continue sitting on this 'time bomb' of a mortgage. As a consumer, evidently all I can do is complain loudly and often.

Replies

Replies